Send Money to India from United States - Fastest & Cheapest Way Comparison

| Service | Exchange rate | Fee | Time | Amount receive | Action |

|---|

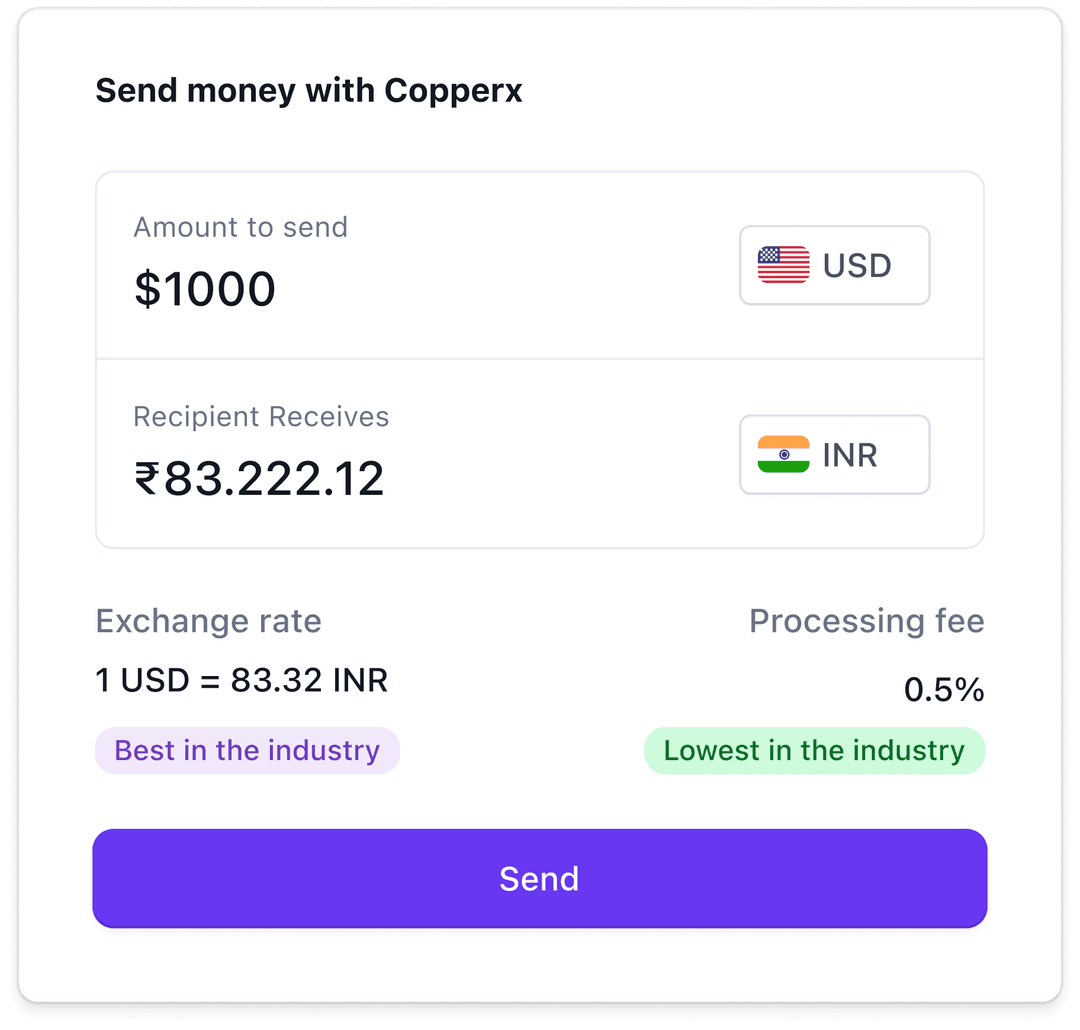

Receive international payments with best rates and lowest fees

Receive INR as if you were in the India.

Get access

Frequently asked questions

The fastest provider in our table to transfer money to India is Wise that takes around 0-2 Days.

Our team of experts have evaluated four services based on various parameters like transfer fees, exchange rates, and speed.

Currently the cheapest: XE

Cheapest cost: $58.21 USD

Currently the fastest: Wise

Fastest time: 0-2 Days

Currently best rated: XE

Money transfer companies included: XE, Wise, Remitly, OFX

What is Money Transfer?

Money transfer refers to the process of sending funds from one individual or entity to another, whether it be domestically or internationally. It provides a convenient and efficient way to send money to family, friends, or businesses in different locations. Money transfers can be conducted through various methods, such as bank transfers, online banking, wire transfers, debit cards, or credit cards. The sender initiates the transfer by providing the recipient's bank account details or by using a designated payment method. The funds are then securely transferred, taking into account exchange rates and any applicable fees. Money transfers are commonly used for a variety of purposes, including paying bills, supporting loved ones, or conducting business transactions. With the advancement of technology, international money transfer services have become more accessible, providing peace of mind with track transfer facilities and offering competitive exchange rates.

Overview of India and Indian Rupee

India, located in South Asia, is a vibrant country known for its rich cultural heritage, diverse population, and rapidly growing economy. With a population of over 1.3 billion people, India is a hub of opportunities and a popular destination for international trade and investments.

The official currency of India is the Indian Rupee (INR), which is symbolized by ₹. The INR is regulated by the Reserve Bank of India, the country's central banking institution. As with any international money transfer, there are certain regulatory requirements that need to be adhered to when sending money to India.

When sending money to India, it is important to consider the current exchange rate, as it can significantly impact the amount received by the beneficiary. Exchange rates fluctuate daily, so staying updated with the latest rates is crucial for a cost-effective transfer.

Popular routes for sending money to India include transfers from Hong Kong and the Philippines, among others. Many international money transfer providers offer convenient and competitive services for transferring money to India, ensuring quick and secure transactions.

Sending money to India has become increasingly convenient with the introduction of online money transfer services. These platforms provide a track transfer facility, allowing users to monitor the progress of their transfer in real-time.

Overall, sending money to India is a seamless process with various options available to suit individual needs. Understanding the regulatory requirements, exchange rates, and popular routes can help users make informed decisions when sending money to this vibrant country.

Reasons to Send Money to India

India is one of the countries that receives a significant amount of remittance transactions from abroad. There are several reasons why individuals may want to send money to India.

Economic factors play a major role in driving the need for international money transfers. Many people working abroad send money back to India to support their families and loved ones. This financial support helps cover essential expenses such as education, healthcare, and daily living. Additionally, business purposes also contribute to the demand for money transfers to India. International trade, investment, and business partnerships often require seamless payment methods to execute transactions smoothly.

On a personal level, supporting family members in India is another common reason for international money transfers. Individuals living abroad often need to send money to elderly parents or relatives to provide them with financial security and peace of mind.

Given these factors, it is important for individuals to find convenient and reliable ways to transfer money to India. International money transfer providers offer various services that cater to the specific needs of people looking to send money to India. These services provide options for transferring funds quickly and securely, ensuring the money reaches its intended recipients in a timely manner.

In conclusion, the demand for international money transfers to India stems from economic factors such as remittance transactions and business purposes, as well as personal support for family members. It is crucial for individuals to choose a reputable money transfer service that offers convenient options and competitive exchange rates to send money to India efficiently.

Popular Payment Options for International Money Transfers

Introduction:

When it comes to sending money internationally, it's important to have easy and convenient payment options. Whether you're looking to transfer funds for personal reasons or business purposes, having a range of popular payment options can ensure a smooth and hassle-free money transfer experience. In this article, we will discuss some of the most popular payment options available for international money transfers, allowing you to choose the method that best suits your needs. From bank transfers to debit cards, cash pickups to online banking, there are various options to consider before making your money transfer. Read on to find out more about these payment methods and which one might be right for you.

Debit Card Payments - Instant Money Transfer

When it comes to international money transfers, using debit card payments can be a convenient and efficient option. With a debit card, you can send money to India and other countries seamlessly.

The process of making debit card payments for international money transfers is relatively straightforward. First, you need to choose a reputable provider that supports debit card payments. Some popular providers include TransferWise, Western Union, and MoneyGram. Once you have selected a provider, you will need to provide the necessary details, such as the recipient's bank account information and the amount you wish to send.

One advantage of using debit card payments is faster transfer times. Unlike traditional bank transfers, which may take several business days to complete, debit card payments often provide instant or same-day transfers. This means your recipient can receive the funds faster, which is especially beneficial in urgent situations.

However, it is important to note that using debit card payments for international money transfers may come with additional fees. These fees can vary depending on the provider and the specific transfer amount. It's essential to compare the fees upfront to ensure you choose the most cost-effective option for your transfer.

In conclusion, debit card payments offer a convenient and faster option for international money transfers. By selecting a provider that supports debit card payments, you can send money to India and other countries with ease. Just be mindful of the potential additional fees associated with this payment method.

Bank Transfers

Sending money to India via bank transfers is a straightforward and secure process. However, there are some requirements and limitations set by the Reserve Bank of India (RBI) for international remittances. To initiate a bank transfer, you need the recipient's bank account details, including the account number and the Indian Financial System Code (IFSC).

When it comes to providers for money transfers from India, there are several options available. Banks like Axis Bank offer international transfer services, but typically require the sender to have an account with them. Other providers such as online money transfer companies cater to individuals who don't have an account.

It is important to check the fees associated with sending or receiving money as these can vary from provider to provider. Some providers offer competitive rates with low fees, while others may charge higher fees while offering added convenience or additional services.

As per RBI regulations, individuals can send up to USD 250,000 per financial year for various purposes including education, medical treatment, or travel. It is crucial to abide by these regulations to ensure a smooth and legal transaction.

In conclusion, bank transfers are a popular method for sending money to India. However, it’s important to consider the requirements and limitations imposed by the Reserve Bank of India and to choose the right provider based on fees and convenience.

Wire Transfers

Wire transfers are a convenient and secure way to send funds directly to a bank account. This method of transferring money allows users to send funds domestically or internationally, making it a popular choice for individuals and businesses alike.

To initiate a wire transfer, the sender typically needs the receiver's bank account details, including the account number and routing number. This ensures that the funds are deposited directly into the intended account. With the proper information, wire transfers can be completed within minutes, providing a quick and efficient way to send money.

Wire transfers offer peace of mind for both senders and recipients. By utilizing bank-to-bank transfers, the funds are securely sent and received, reducing the risk of loss or theft. Additionally, wire transfers can be tracked, providing a sense of security throughout the whole process.

Whether you need to send money to a family member overseas or make a business payment, wire transfers offer a reliable and efficient solution. With the recipient's bank account details in hand, you can quickly send funds directly to their account, ensuring a seamless and timely transaction.

Cash Pickup Option

When sending money to India, one convenient option is the cash pickup service. This allows the recipient to collect the funds in person from a designated location.

To send money for cash pickup, you start by entering the desired amount you wish to send. Then, provide the recipient's details, including their name and contact information. It's important to ensure accuracy to avoid any delays or issues.

Next, you can select a pickup location in India. Some popular options include Muthoot Finance and Manappuram Finance, which have numerous branches across the country. These locations provide a secure and reliable environment for recipients to collect their funds.

Finally, you can choose a payment method for the transaction. Depending on the service provider, options may include bank transfers, debit cards, or online banking. It's advisable to consider factors such as fees, exchange rates, and transfer times when selecting the most suitable payment method for your needs.

Overall, the cash pickup option offers a convenient and efficient way to send money to India. Recipients can easily collect their funds from designated locations, providing peace of mind for both the sender and the receiver.

Important Factors in Choosing a Money Transfer Service

When choosing a money transfer service, there are several important factors to consider. One of the key factors to look at is the exchange rates offered by the service. Exchange rates can vary widely between different providers, so it is essential to compare rates to ensure you are getting the best value for your money. The speed of the transfer is another crucial factor. Depending on your needs, you may require a service that offers instant transfers or one that takes a few business days. Additionally, the payment options available should be taken into account. Some services offer various payment methods such as bank transfers, debit cards, or credit cards, providing flexibility for the sender. The fees charged by the service provider should also be considered, as some companies may have lower fees than others. Lastly, it is important to look for a provider that offers the peace of mind of secure and regulated transactions. By considering these important factors, you can choose the money transfer service that best suits your needs.

Exchange Rate Markup Fee and Promotional Exchange Rates

When sending money to India, it's important to consider two key factors that can impact the overall cost of your transfer: exchange rate markup fees and promotional exchange rates.

The exchange rate markup fee is an additional charge imposed by the money transfer service provider on top of the mid-market rate. This fee represents the provider's profit margin. For example, if the mid-market rate is 1 USD = 75 INR, and the provider applies a 2% markup fee, then the actual exchange rate offered to you would be 1 USD = 73.5 INR. This difference in exchange rate can significantly affect the amount your recipient receives.

Promotional exchange rates, on the other hand, are special rates offered by money transfer providers for a limited time period or specific transactions. These rates are often more favorable than the regular exchange rates. For instance, a provider may offer a promotional rate of 1 USD = 76 INR for a certain duration, which is better than the standard rate of 1 USD = 75 INR. This can be beneficial if you take advantage of the promotion.

However, it's essential to carefully consider promotional exchange rates as they may come with certain drawbacks. Firstly, these rates may only be applicable for a limited time, meaning you may not have control over when you can send money at the promotional rate. Additionally, providers may set certain conditions, such as minimum transfer amounts or specific payment methods, to qualify for the promotional rate. Failing to meet these conditions may result in you receiving the regular, less favorable exchange rate.

In summary, exchange rate markup fees and promotional exchange rates can have a substantial impact on the overall cost of transferring money to India. While promotional rates may seem attractive, it's crucial to understand any limitations or requirements associated with them to avoid any surprises or added costs.

Transfer Time and Delivery Times

When sending money to India, it is important to consider the transfer time and delivery times to ensure that your funds reach their destination in a timely manner. The estimated time for delivery can vary depending on several factors including the remittance provider, the payment method chosen, and the regulatory requirements in the respective countries.

While many providers offer quick and convenient transfer options, the actual delivery time may be influenced by a number of factors including the processing time by the sending and receiving banks, any additional security checks required, and the availability of local banking systems.

It is also worth noting that some providers offer guaranteed delivery times for transfers from certain countries, such as the United States. This means that they ensure that your money will be delivered within a specific timeframe, giving you peace of mind and allowing you to plan accordingly.

To get the most up-to-date information on transfer times and delivery times for sending money to India, it is recommended to contact the remittance provider directly or utilize their online platforms which often include a track transfer facility. This will enable you to stay informed and have transparency about the progress of your transfer.

In conclusion, while the estimated time for delivery plays a crucial role in planning your money transfer, it is important to consider factors that may affect the actual delivery time. Utilizing the services of a specialist money transfer service provider will not only provide you with convenience but also ensure a reliable and efficient transfer process.

Online Banking and Security Features

When sending money to India, the convenience and security provided by online banking features are crucial for customers' peace of mind. Money transfer providers offer a range of security measures to ensure the safety of online transactions. One of the key features is encryption, which safeguards the personal and financial information exchanged during the transfer process.

Additionally, multi-factor authentication adds an extra layer of protection by requiring users to verify their identity through multiple means, such as passwords, security questions, or biometrics. These measures help prevent unauthorized access to accounts and ensure that only legitimate users can initiate money transfers.

Online banking also offers the convenience of tracking transfers in real-time. Customers can easily monitor the progress of their transactions, providing them with peace of mind and assurance that their money will reach its intended recipient promptly.

Furthermore, rate alerts are another beneficial feature of online banking. Customers can set up notifications to receive real-time updates on exchange rates, allowing them to make informed decisions and choose the optimal time to send money to India.

Overall, the combination of strong security features, such as encryption and multi-factor authentication, along with the convenience of tracking transfers and rate alerts, gives customers the peace of mind they need when sending money to India through online banking.

Fees Associated with Money Transfers

When it comes to money transfers, it's important to be aware of the fees involved. There are various types of fees that may be incurred, depending on the transfer type and payment method chosen.

For bank debit transfers, there is often a small fee that is charged by the bank for the service. This fee is typically deducted from the transferred amount. Similarly, wire transfers may also incur a fee for processing the transaction.

It's worth noting that while fees are a common part of money transfers, they are generally small in comparison to the overall transfer amount. This ensures that the majority of your money reaches its intended recipient.

To minimize fees, it is recommended to compare different transfer options and providers. Some providers may offer lower fees or even fee-free transfers for certain payment methods. It's also worth considering the transfer time and convenience of different options.

By understanding the fees associated with money transfers and comparing different transfer types and providers, you can make an informed choice that suits your needs and budget.

Best Practices When Sending Money to India

Sending money to India involves several considerations to ensure a smooth and secure transaction. Here are some best practices to follow when sending money to India:

- Choose a Reputable Service Provider:

- Use well-known and reputable money transfer services or banks to ensure the safety of your funds.

- Compare fees, exchange rates, and transfer time among different providers.

- Understand Fees and Exchange Rates:

- Be aware of the fees associated with the transfer. Some providers offer low transfer fees but might have unfavorable exchange rates.

- Look for services offering competitive exchange rates to maximize the value of your money.

- Consider Transfer Speed:

- Consider the urgency of the transfer. Some services offer faster transfers for a higher fee, while others might take longer but charge lower fees.

- Understand the processing time required by the service provider, especially if you need the recipient to receive the money quickly.

- Verify Recipient Details:

- Double-check the recipient's name, bank account number, and other details to ensure the money reaches the right person.

- Provide accurate information to the service provider to avoid delays or issues with the transfer.

- Use Secure Channels:

- Use secure and trusted internet connections and devices when initiating the transfer.

- Avoid public Wi-Fi networks and use a secure, password-protected connection to prevent unauthorized access to your financial information.

- Be Cautious with Online Transactions:

- Be cautious when clicking on links or providing personal information online. Use official websites or mobile apps of the service provider.

- Avoid sharing sensitive information like passwords or PINs with anyone, including customer service representatives.

- Consider Hedging Against Exchange Rate Fluctuations:

- If you are sending a large sum, consider using tools like forward contracts or limit orders to hedge against adverse exchange rate movements.

- Familiarize Yourself with Regulations:

- Understand the regulations governing international money transfers in both your country and India.

- Be aware of any taxes or reporting requirements related to the money transfer.

- Keep Records:

- Keep a record of the transaction, including receipts, confirmation numbers, and any communication with the service provider.

- This documentation can be valuable in case any issues arise during or after the transfer.

- Educate the Recipient:

- Make sure the recipient is aware of the transaction details and knows how to access the funds once they arrive in their account.

- Advise them to contact their bank if they encounter any issues receiving the money.